TOKYO: Oil in London fell below US$50 a barrel for the first time since July 2017 as broader financial market turmoil and worries over U.S. supply countered signals from the OPEC+ coalition that it may extend or deepen output cuts.

Oil in London dips below US$50 as market chaos counters OPEC+ Cuts

Futures fell as much as 1.1 percent, after Monday’s 6.2 percent drop. Russian Energy Minister Alexander Novak tried to reassure investors, saying the market will be more stable in the first half of 2019 due to the deal between OPEC and its allies to cut output and producers will react if the situation changes.

Meanwhile, S&P 500 Index futures swung between gains and losses Wednesday while the benchmark U.S. gauge is at the brink of sliding into a bear market.

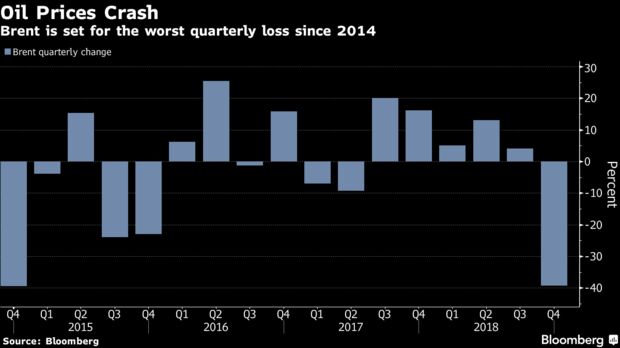

Oil has plunged more than 40 percent from a four-year high in October on the prospect of a supply glut. While the Organization of Petroleum Exporting Countries and allies including Russia agreed to cut output early this month, investors are skeptical the reductions will be sufficient to dent supplies, with U.S. producers pumping near a record.

At the same time, President Donald Trump’s trade war with China and the Federal Reserve’s policy on interest rates have clouded the outlook for global economic growth.

“There are several bearish factors in oil markets, and the situation won’t improve anytime soon. The current bear market will likely continue for some time,” Satoru Yoshida, a commodity analyst at Rakuten Securities Inc. in Tokyo., said by phone. “Oil prices could rise if OPEC+ make announcements about specific measures” including additional cuts, Yoshida said.

Brent for February settlement declined as much as 54 cents to $49.93 a barrel on the London-based ICE Futures Europe exchange, before paring losses to trade at $50.36 at 11:27 a.m. in Tokyo.

Prices plunged $3.35 to $50.47 on Monday. Trading was closed on Tuesday for the Christmas holiday. The global benchmark crude traded at a $7.50 premium to West Texas Intermediate.

WTI for February delivery was 35 cents higher at $42.88 a barrel on the New York Mercantile Exchange. The contract slumped $3.06 to $42.53 on Monday. Total volume traded was more than twice the 100-day average. - Bloomberg

Read more at https://www.thestar.com.my/business/business-news/2018/12/26/oil-in-london-dips-below-us$50-as-market-chaos-counters-opec-cuts/#tvmuZAqZixkumcfV.99

Oil in London dips below US$50 as market chaos counters OPEC+ Cuts

Futures fell as much as 1.1 percent, after Monday’s 6.2 percent drop. Russian Energy Minister Alexander Novak tried to reassure investors, saying the market will be more stable in the first half of 2019 due to the deal between OPEC and its allies to cut output and producers will react if the situation changes.

Meanwhile, S&P 500 Index futures swung between gains and losses Wednesday while the benchmark U.S. gauge is at the brink of sliding into a bear market.

Oil has plunged more than 40 percent from a four-year high in October on the prospect of a supply glut. While the Organization of Petroleum Exporting Countries and allies including Russia agreed to cut output early this month, investors are skeptical the reductions will be sufficient to dent supplies, with U.S. producers pumping near a record.

At the same time, President Donald Trump’s trade war with China and the Federal Reserve’s policy on interest rates have clouded the outlook for global economic growth.

“There are several bearish factors in oil markets, and the situation won’t improve anytime soon. The current bear market will likely continue for some time,” Satoru Yoshida, a commodity analyst at Rakuten Securities Inc. in Tokyo., said by phone. “Oil prices could rise if OPEC+ make announcements about specific measures” including additional cuts, Yoshida said.

Brent for February settlement declined as much as 54 cents to $49.93 a barrel on the London-based ICE Futures Europe exchange, before paring losses to trade at $50.36 at 11:27 a.m. in Tokyo.

Prices plunged $3.35 to $50.47 on Monday. Trading was closed on Tuesday for the Christmas holiday. The global benchmark crude traded at a $7.50 premium to West Texas Intermediate.

WTI for February delivery was 35 cents higher at $42.88 a barrel on the New York Mercantile Exchange. The contract slumped $3.06 to $42.53 on Monday. Total volume traded was more than twice the 100-day average. - Bloomberg

Read more at https://www.thestar.com.my/business/business-news/2018/12/26/oil-in-london-dips-below-us$50-as-market-chaos-counters-opec-cuts/#tvmuZAqZixkumcfV.99