#Budget2019: 25 Highlights From Pakatan Harapan's First Budget In Power

Malaysia's Budget 2019 is themed "A Resurgent Malaysia, A Dynamic Economy, A Prosperous Society".

- Finance Minister Lim Guan Eng has tabled Pakatan Harapan's Budget 2019 amid allegations of fund misappropriations, dubious spending, and debt by the previous Barisan Nasional administration

- The theme of this budget is "Malaysia Wibawa, Ekonomi Dinamik, Rakyat Sejahtera" (A Resurgent Malaysia, A Dynamic Economy, A Prosperous Society).

Lim said the budget includes three main focuses to ensure Malaysia can regain its economic standing as the Tiger of Asia:

- Institutional reforms,

- Ensuring people's welfare, and

- Entrepreneurship culture across the country. - This federal budget goes down in history for being the first tabled by a new government since 1957.

Previously, New Straits Times reported Pakatan Harapan as assuring Malaysians that fixing the "mess" left behind by the Barisan Nasional administration will not be done at the people's expense.

Finance Minister Lim Guan Eng - Here's the breakdown of Budget 2019's RM314.55 billion allocation:

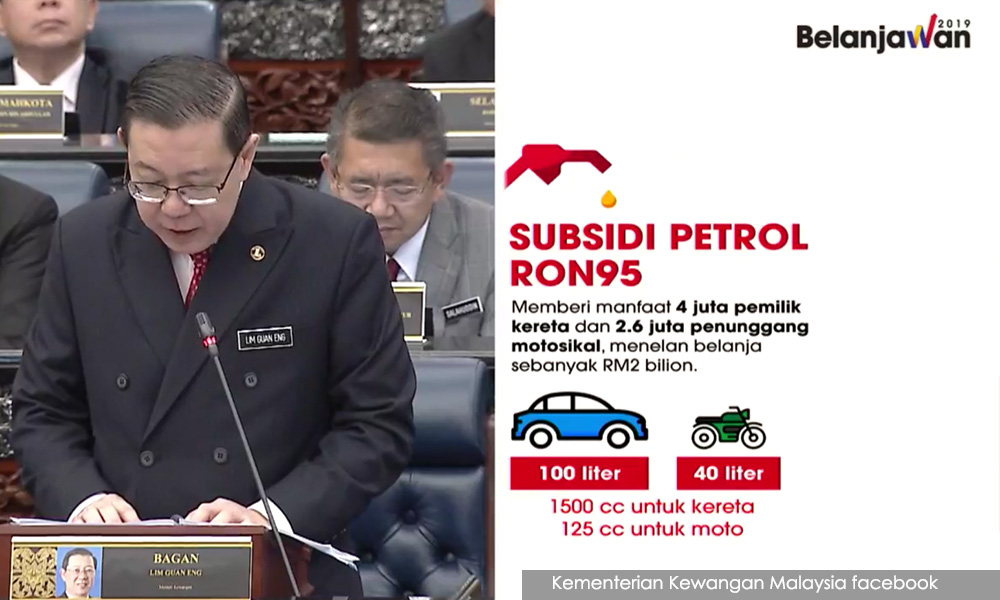

1. Petrol subsidy

- Petrol subsidies will be provided to car owners with engines under 1,500cc and motorcyclists with engines under 125cc.

The RON95 will also be subsidised with RM0.30 per litre up to:

- 100 litres for a car, and

- 40 litres for a motorcycle.

RM2 billion have been allocated for this subsidy.

2. Frozen toll hikes

- Intra-city toll rate hikes have been frozen following an allocation of RM700 million.

Beginning 2019, tolls will also be abolished for motorcycles on two bridges:

- Penang island to mainland, and

- Johor Second Link.

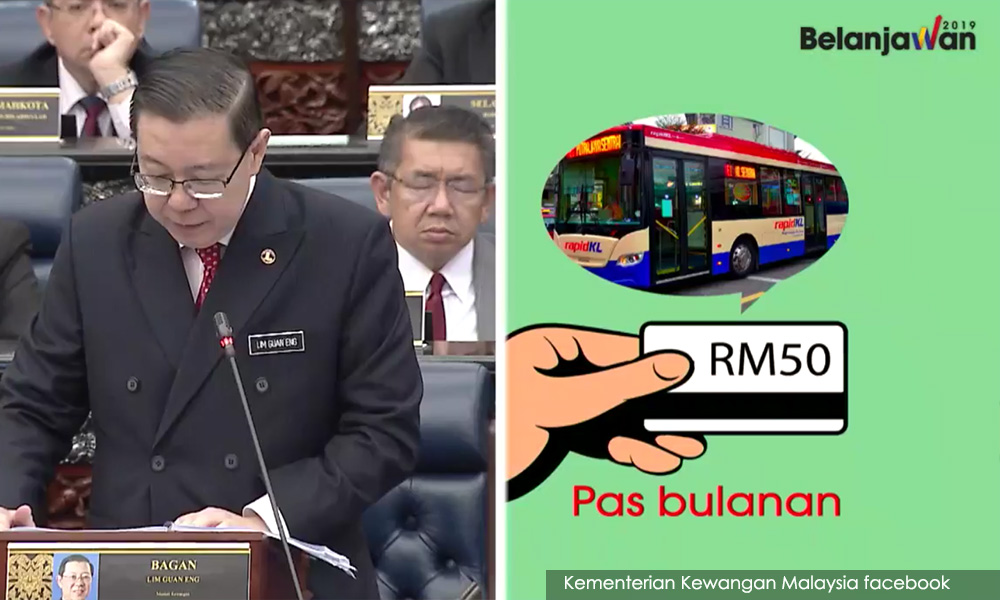

3. Transport

- Beginning January 2019, monthly passes of RM100 will be made available to public transportation users for unlimited trips on RapidKL rail or bus services.

For bus users, RM50 monthly passes will be made available to them.

This scheme will be extended to other bus companies in stages.

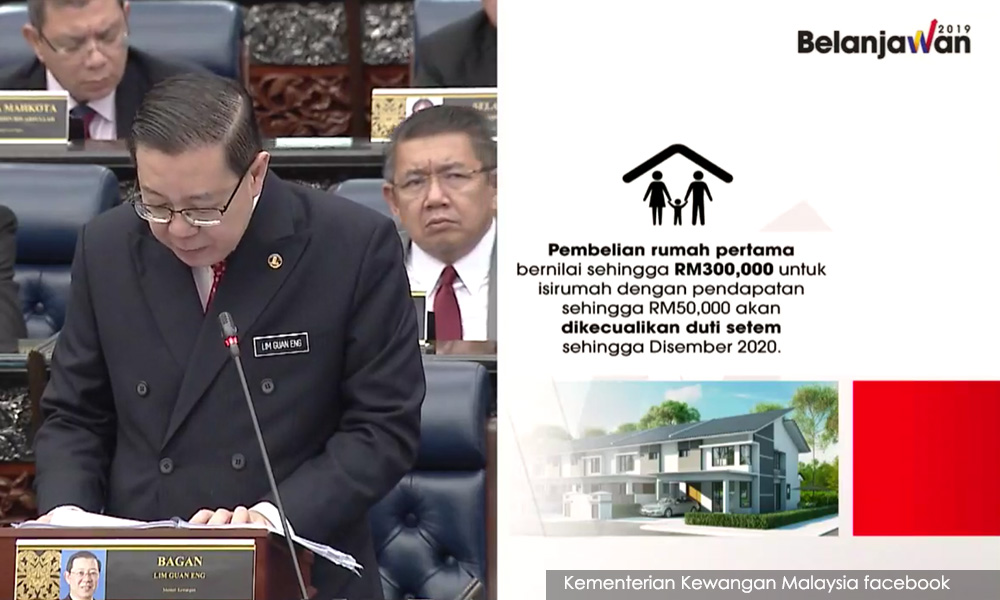

4. Housing

- For first-time home buyers in the private sector, the government has announced a "Peer-to-Peer Lending Scheme" to allow a "property crowdfunding" model regulated by the Securities Commission.

For instance, a buyer may purchase a RM250,000 home by paying on RM50,000while the balance is financed by investors through the scheme.

The scheme is expected to be launched in the first quarter of 2019. - Meanwhile, the government has allocated RM1 billion to facilitate home ownership for the low-income group. The allocation goes to those earning under RM2,300 to own homes under RM150,000. First-time buyers for houses up to RM500,000 will also be exempted from stamp duties until December 2020.

Cagamas Berhad gets RM25 million to provide mortgages for first-time buyers earning below RM5,000.

5. Financial aid for low-income group

- Beginning 1 January 2019, families with a household income of under RM4,000 will get Bantuan Sara Hidup (BSH), the government's version of BR1M.

Here's the breakdown of BSH for households:

- RM1,000 for income under RM2,000

- RM700 for income between RM2,0001 and RM3,000,

- RM500 for income between RM3,001 and RM4,000.

6. FELDA

- The allocation for FELDA settlements include:

- RM100 million to improve roads,

- RM160 million to improve water supply, and

- RM35 million to build and improve infrastructure as well as install lights.

Meanwhile, Sabah receives RM5 billion for development and Sarawak receives RM4.3 billion.

7. Equitable development

- The government has allocated the following for development:

- RM926 million to upgrade roads, rural roads, and bridges,

- RM694 million for improvement of rural access to electricity,

- RM738 million for improvement of rural access to water,

- RM85 million to upgrade and repair infrastructure in new villages,

- RM100 million to support the Indian community (skill training and employment),

- RM100 million for development of the Orang Asli community, and

- RM20 million for registered resident associations (community programmes, security).

8. Cash handout for uniformed units and civil servants

- A RM500 handout will be paid to:

- Police,

- Military,

- Fire and Rescue Department,

- Customs Department under Grade 54, and

- Eligible pensioners (under RM1,000).

Meanwhile, RM250 will be paid to all government pensioners.

9. Minimum salary of RM1,100

- Lim confirmed that the minimum wage will be standardised at RM1,100 across the country beginning 1 January 2019.

Moreover, Malaysians above the age of 60 who wish to work will have their mandatory EPF contributions reduced from 6% to 4%. Their income will also not deducted for EPF contributions to increase the money available to them.

Companies that hire senior citizens with a monthly salary limit of RM4,000 will have tax incentives.

10. PTPTN

- For PTPTN borrowers earning over RM1,000 per month, a payment system through deductions between 2% and 15% from the borrower's salary has been announced.

Moreover, a tax break will be given to companies that aid their staff to settle PTPTN loans by the end of 2019. Individual income tax breaks under the National Education Saving Scheme has been increased to RM8,000.

Meanwhile, the loans of borrowers aged above 60 with a monthly income of under RM4,000 have have been waived.

11. Education

- RM60.2 billion will be allocated to the Education Ministry, constituting 19.1% of the total amount for Budget 2019.

Among the initiatives that will be executed include:

- RM2.9 billion education assistance (food supply, textbooks, and cash aid) for the poor

- RM250 million for Sekolah Kebangsaan,

- RM50 million for Chinese vernacular schools,

- RM50 million for Tamil vernacular schools,

- RM50 million for full boarding schools,

- RM50 million for Maktab Rendah Sains MARA,

- RM50 million for government assisted religious schools,

- RM50 million for missionary schools,

- RM50 million for Tahfiz schools,

- RM25 million for registered pondok schools,

- RM15 million for Sekolah Menengah Jenis Kebangsaan (SMJK) or Conforming Schools, and

- RM12 million for Chinese private secondary schools.

Meanwhile, RM3.8 billion have been allocated for government scholarships, and RM400 million have been allocated for university research.

Bumiputeras will be empowered with the RM210 million allocation for education and human capital development programmes.

RM10 million have been allocated to encourage and develop e-sports.

12. Healthcare

- In collaboration with Great Eastern, the National Health Protection Fund will be launched for families in the B40 category.

The fund offers free protection for critical diseases in these areas:

- An aid of up to RM8,000 for treatment,

- Daily income replacement during hospital treatment for 14 days maximum at RM700 per year.

Meanwhile, RM10 million have been allocated to extend medical benefits to parents of contractual civil servants. Those whose children contracted infectious diseases will be eligible for quarantine leave.

13. Childcare centres in government offices

- 50 new childcare centres (TASKA) will be built at government offices following an allocation of RM10 million.

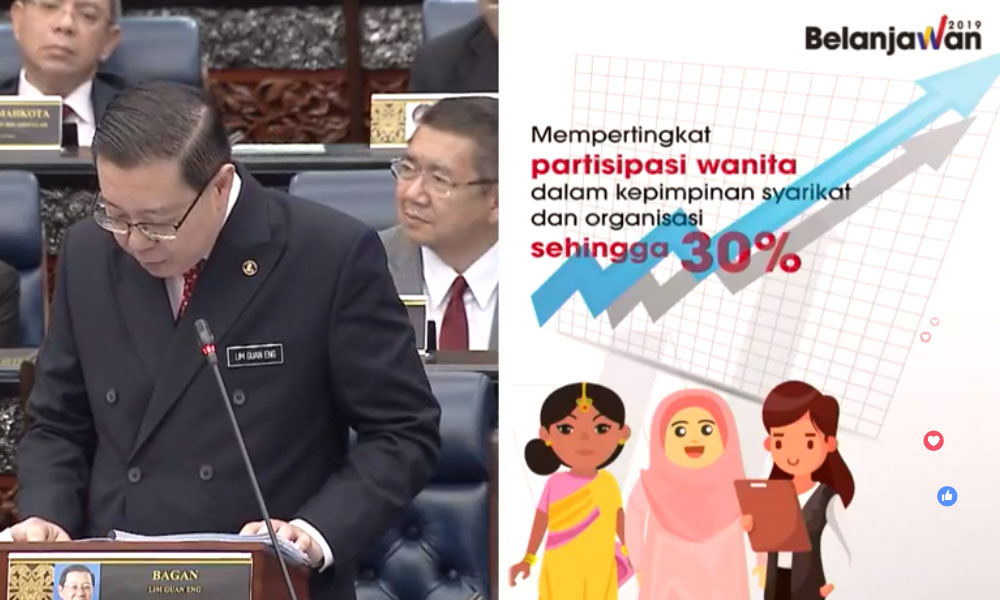

The government will also continue to provide incentives for the private sector to give equal employment opportunities for women.

14. Smoke-free nation

- The Finance Minister announced that the government aims to turn Malaysia into a smoke-free nation by 2025.

Lim also reiterated the smoking ban imposed on all restaurants and eateries beginning 2019. It will be gazetted then.

15. Return of the 'Buy Malaysian Products' campaign

- RM20 million have been allocated for the campaign, which was previously implemented during Prime Minister Tun Dr. Mahathir Mohamad's first stint in office.

According to Lim, the campaign provides local manufacturers and service providers access to hypermarkets, shopping warehouses, and trade expos.

16. Imported services will be taxed

- Beginning 2020, imported services will be taxed to ensure that local service providers can become more competitive in the international market.

According to Lim, these services will be required to register with the Customs Department.

Online services affected by this include:

- Softwares,

- Music,

- Videos, and

- Any form of digital advertising.

17. SST exemptions

- SST exemptions will be granted to specific services provided by registered businesses to other registered businesses beginning 1 January 2019.

A tax credit system will also be introduced for small manufacturers who purchase sources materials from importers and not registered factories.

18. Real Property Gains Tax

- The government has raised the Real Property Gains Tax (RPGT) for locals from 0% to 5%. Exceptions will be made for homes under RM200,000.

Meanwhile, companies and foreigners who are not permanent residents will face a 10% RPGT, and stamp duty for properties over RM1 million will be raised from 3% to 4%.

19. International travel tax

- All outgoing flights form Malaysia will be slapped with a levy beginning 1 June 2019. According to Lim, the government aims to encourage domestic travel with this move.

Here are the categories for the tax:

- RM20 for flights to ASEAN countries,

- RM40 for flights to other countries.

20. Sugar tax

- Beginning April 2019, an excise duty will be imposed on sugary drinks for RM0.40 per litre.

The tax applies to:

- Drinks with additional sugar or sweeteners exceeding 5g per 100ml, and

- Fruit and vegetable juices with a sugar content exceeding 12g per 100ml.

21. "Gambling" tax

- The license fee for casinos has been increased from RM120 million to RM150 million. Duties of casinos have also been increased to 35% of the gross income.

Annual license fee for dealer machines has been increased from RM10,000 to RM50,000. The duty fee for it is increased from 20% to 30% of the gross income.

Meanwhile, the number of special draws has been decreased by 50%.

22. Pangkor Island will become duty-free

- Lim said the island will be made duty-free to realise its potential as one of Malaysia's main tourism destinations.

Nonetheless, the decision will be bound by certain conditions.

23. Internet

- Lim announced the National Fiberisation and Connectivity Plan, and expects 30 Mbps of broadband connectivity outside urban areas within five years of the plan's implementation.

According to him, this plan portrays the government's commitment to digitising the country's economy.

Meanwhile, broadband prices are expected to drop by 25% by the end of 2018.

24. Malaysian Anti-Corruption Commission (MACC)

- RM242.1 million have been allocated to MACC due to the need for recruitment. The agency will be hiring an additional 100 people.

"MACC needs enough human resources to fight graft and money laundering in both public and private sectors, as well as to recover assets," Lim said.

25. Religion

- RM1.2 billion will be allocated to JAKIM in 2019, an increase from the RM1.1 billion in Budget 2018.

Meanwhile, Muslim and non-Muslim civil servants are entitled to a one-off unrecorded leave of seven days to perform their respective religious obligations.